2025 Roth Ira Contribution Limits Table 2025. You can make 2025 ira contributions until the. To max out your roth ira contribution in 2025, your income must be:

Your personal roth ira contribution limit, or eligibility to. Roth ira contribution limits (tax year 2025) brokerage products:

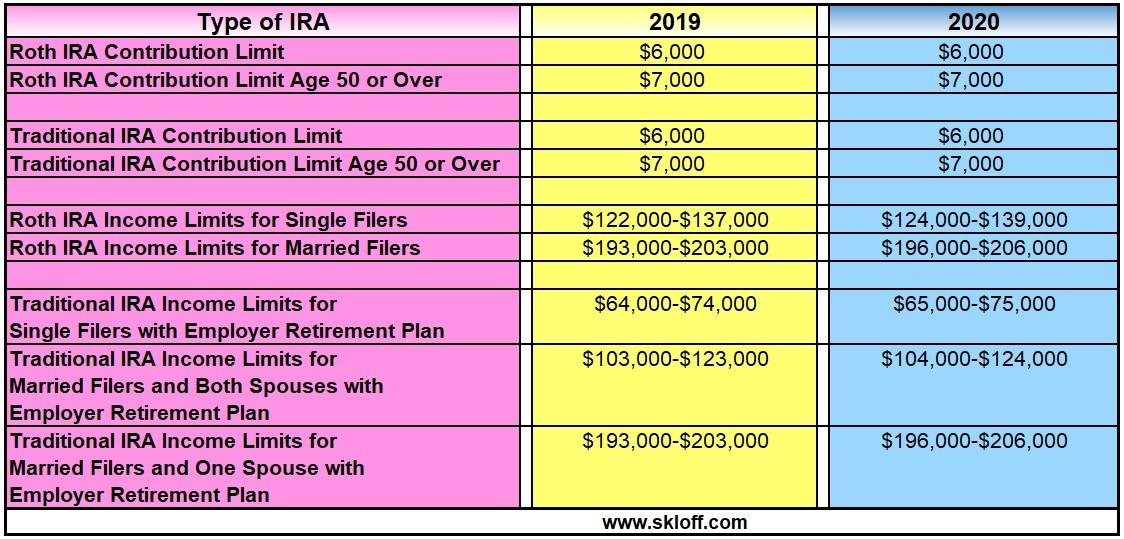

2025 Contribution Limits Announced by the IRS, The table below shows the income limits for 2025 and 2024 for making roth contributions. 2025 contribution limits for different age groups:

Ira Annual Limit 2025 Mitzi Teriann, The annual roth ira contribution limit in 2025 is $6,500 for adults younger than 50 and $7,500 for adults 50 and older. Roth iras are another viable option for saving for retirement.

Roth Ira 2025 Contribution Limit Irs Over 50 Brooke Clemmie, Less than $146,000 if you are a single filer. 2025 roth ira income limits.

401k 2025 Contribution Limit Chart, Taxpayers can also apply the excess to the next year’s contribution. Roth iras are another viable option for saving for retirement.

Roth IRA Limits And Maximum Contribution For 2025, Roth iras are another viable option for saving for retirement. To max out your roth ira contribution in 2025, your income must be:

What’s the Maximum 401k Contribution Limit in 2025? (2025), For the 2025 tax season, standard roth ira contribution limits increased from last year, with a $7,000 limit for individuals. Roth ira contribution limits (tax year 2025) brokerage products:

Is A Backdoor Roth IRA A Good Move For Higher Earners?, The annual roth ira contribution limit in 2025 is $6,500 for adults younger than 50 and $7,500 for adults 50 and older. Less than $230,000 if you are married filing jointly.

IRA Contribution and Limits for 2019 and 2025 Skloff Financial, To max out your roth ira contribution in 2025, your income must be: You can also contribute the full $7,000 to a roth ira for 2025.

Rmd Table 2025 Inherited Ira Contribution Lucky Regine, If you're age 50 and older, you. You can also contribute the full $7,000 to a roth ira for 2025.

2025 Limits Alidia Randie, 12 rows the maximum total annual contribution for all your iras combined is: If you are 50 or older by the end of 2025, you may contribute up to $8,000 to a roth ira.